ETH Price Prediction 2025-2040: Technical and Fundamental Analysis

#ETH

- Current technical indicators show ETH trading below its 20-day moving average with mixed momentum signals

- Fundamental developments include both positive institutional adoption and regulatory challenges

- Long-term price projections reflect Ethereum's potential as a foundational blockchain platform

ETH Price Prediction

Technical Analysis: ETH Shows Mixed Signals Amid Current Market Conditions

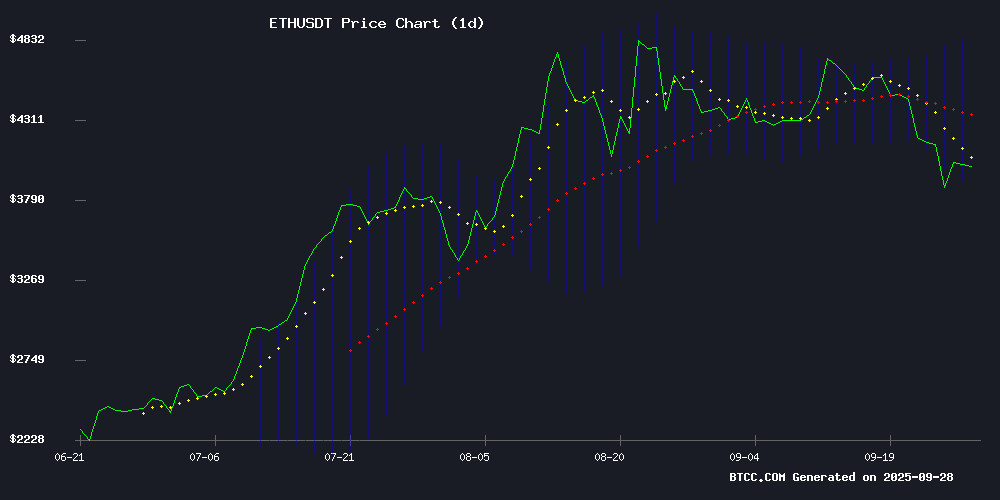

According to BTCC financial analyst Mia, Ethereum's current technical indicators present a complex picture. With ETH trading at $4,033.54, below its 20-day moving average of $4,358.66, the short-term momentum appears bearish. However, the MACD reading of 195.12 suggests underlying strength, while the Bollinger Bands position indicates ETH is trading in the lower range of its recent volatility band between $3,879.28 and $4,838.05.

Mia notes that the current technical setup suggests consolidation may be underway, with key resistance at the 20-day MA and support NEAR the lower Bollinger Band. Traders should watch for a break above $4,358.66 for bullish confirmation or a drop below $3,879.28 for bearish continuation.

Market Sentiment: Mixed Fundamentals Create Uncertain ETH Outlook

BTCC financial analyst Mia comments that recent ethereum news flow creates conflicting signals for market sentiment. Positive developments including SWIFT's partnership with Ethereum's Linea for cross-border payments and Vitalik Buterin's highlighting of scaling solutions provide fundamental support. However, the Hypervault Finance rug pull and regulatory scrutiny of Base Network create headwinds.

Mia observes that institutional support and staking demand continue to provide underlying strength, while regulatory concerns and capital rotation to emerging projects present near-term challenges. The mixed news environment aligns with the technical picture of consolidation and uncertainty.

Factors Influencing ETH's Price

Vitalik Buterin's Uniswap Memecoin Trade Sparks Market Ripples

Ethereum co-founder Vitalik Buterin catalyzed volatility in the memecoin sector after liquidating two unsolicited tokens on Uniswap. The September 28 transaction saw 150 billion PUPPIES tokens and 100 million units of an unnamed ERC-20 asset converted into 28.58 WETH and 13,889 USDC respectively—netting $114,700 in under two hours.

Blockchain analysts traced the rapid-fire trades to Buterin's wallet, underscoring how founder-level activity can move niche crypto markets. The event highlights both the liquidity advantages of decentralized exchanges and the amplified sensitivity of speculative assets to whale movements.

SWIFT Partners with Ethereum's Linea for Blockchain Cross-Border Payment Pilot

SWIFT, the global financial messaging network, is collaborating with Ethereum-based Linea to test blockchain technology for interbank transactions. The pilot focuses on leveraging zero-knowledge proofs to enhance privacy and efficiency in cross-border payments.

Major institutions including BNP Paribas and BNY Mellon are participating in the initiative, which could reshape global payment infrastructure. The partnership signals growing institutional adoption of Ethereum's scaling solutions for financial applications.

SWIFT's exploration of a potential stablecoin integration underscores blockchain's disruptive potential in traditional finance. The test marks a significant step toward modernizing legacy settlement systems with decentralized technology.

Hypervault Finance Loses $3.6 Million in Suspected Rug Pull

Hypervault Finance has become the latest casualty in a string of DeFi rug pulls, with $3.6 million vanishing from its platform. The funds were siphoned through suspicious withdrawals routed through Tornado Cash, a privacy-focused mixer. Security firms PeckShield and CertiK identified the transactions as exhibiting classic rug pull behavior.

The project's digital footprint evaporated shortly after the incident—its website, social media accounts, and Discord server all disappeared without explanation. This exit scam occurred just days after Hypervault announced surpassing $5 million in total value locked, adding insult to injury for investors.

The stolen funds followed a deliberate laundering path: initially bridged from Hyperliquid to Ethereum, converted to ETH, then funneled through Tornado Cash to obscure their trail. Approximately 752 ETH remains unaccounted for in what appears to be a calculated theft.

This incident continues 2025's troubling trend of high-value DeFi exploits, following MetaYield Farm's $290 million heist and Mantra's staggering $5.5 billion investor losses. The cryptocurrency community has grown increasingly wary of such exit scams, with security experts urging investors to revoke wallet permissions immediately after suspicious activity.

Ethereum Surges Past $4,000 Amid Institutional Support and Staking Demand

Ethereum reclaimed the $4,000 threshold on September 25, marking a 2.2% daily gain to trade at $4,013. The rebound defied weekend liquidity constraints, fueled by renewed on-chain activity and institutional inflows.

Staking contracts absorbed 2,589 ETH within 24 hours, pushing total staked ETH to 35.7 million—a $11 billion valuation at current prices. This demand counterbalanced Friday's liquidations, stabilizing sell-side pressure.

Institutional momentum accelerated as T. Rex's 2x BitMine ETF (BMNU) drew $32 million on its debut, ranking among 2025's top three ETF launches. The ETF's performance underscores growing traditional finance appetite for crypto exposure.

Ethereum Supply Crunch Intensifies as Whales Accumulate $1.73 Billion in ETH

Ethereum's exchange supply has plummeted to a nine-year low of 14.8 million ETH, marking a 52% decline from peak levels. This tightening liquidity coincides with a whale buying spree that saw 431,018 ETH ($1.73 billion) withdrawn from major exchanges between September 25-27.

Analysts warn of heightened volatility as critical support zones emerge at $3,515, $3,020, and $2,772. The $3,700-$3,800 range now represents a key liquidation risk zone that could trigger cascading sell orders if tested.

Institutional demand appears strong with ETH staking contracts and custody solutions absorbing supply. The launch of Ethereum staking ETFs has further constrained available liquidity, creating conditions for potential price dislocations.

Ethereum Price Prediction: Diverging Views on ETH's 2025 Trajectory

Ethereum stands at a crossroads as analysts clash over its 2025 price potential. Institutional and retail interest remains strong, yet recent market turbulence—including a $1 billion liquidation wave—has injected fresh uncertainty. The battle lines are drawn between bulls targeting $7,000+ and bears warning of sub-$3,000 scenarios.

Standard Chartered's $7,500 year-end forecast highlights Ethereum's growing staking demand and stablecoin dominance, while Citi's conservative $4,300 projection reflects concerns over overbought optimism. Support levels near $4,200 now serve as a critical litmus test for ETH's near-term direction.

Meanwhile, DeFi innovators are gaining traction, with one unnamed project already securing CEX listings during its wallet beta phase—a sign of shifting capital flows within the ecosystem.

Coinbase CLO Defends Base Network Amid SEC Scrutiny, Denies Exchange Classification

Paul Grewal, Chief Legal Officer of Coinbase, has firmly rejected assertions that the company's Base network functions as a securities exchange. In a recent interview, Grewal emphasized that Base operates purely as Layer-2 blockchain infrastructure, drawing a clear distinction between the protocol and applications built atop it.

The legal clarification comes as U.S. regulators intensify scrutiny of crypto platforms. Grewal's argument hinges on the technical reality that Base doesn't directly match buyers and sellers—a key criterion in the SEC's exchange definition. Transaction matching occurs within decentralized applications utilizing Base's infrastructure, not at the protocol level.

Ripple's David Schwartz bolstered this position with an apt analogy: Layer-2 networks resemble cloud service providers like AWS, merely offering the underlying infrastructure rather than controlling applications running on it. This distinction could prove pivotal in upcoming regulatory discussions.

Coinbase's exploration of a potential native token for Base adds another layer of complexity to the regulatory conversation. The exchange maintains no final decision has been made regarding such an offering.

Ethereum Hits 2-Month Low as Analysts Flag Risk of Further Decline to $3,500

Ether plunged below $3,900 amid a broad crypto selloff, marking its weakest level in two months. The second-largest cryptocurrency now faces critical support at $3,800, with analysts warning of potential downside toward $3,500 if the level fails to hold.

Market data reveals nearly $1 billion in liquidations this week, with Ethereum positions accounting for $312 million of the damage. The selloff gained momentum after BlackRock offloaded $25.6 million worth of ETH, fueling concerns about institutional retreat. Options traders are positioning for further pain, with put demand outpacing calls.

Veteran analyst Ted Pillows draws parallels to Bitcoin's 2020 cycle, where a 25%-30% correction followed a breakout. His models suggest Ether could slide another 10%-15% before finding a bottom. The $3,800 zone now serves as the battleground between bulls and bears.

Ethereum Price Slips Below Key Level as Capital Shifts to Emerging Projects

Ethereum's price breached a critical support level today, triggering concerns among traders about potential further declines. The downturn coincides with growing interest in alternative investment opportunities, such as the Paydax Protocol, which has raised over $600,000 in its ongoing presale.

Market analysts attribute ETH's weakness to multiple factors, including profit-taking after summer rallies and declining network revenue from reduced DeFi activity. Lower gas fees, while beneficial for users, have paradoxically signaled slowing ecosystem momentum. This has led some investors to reallocate capital toward newer projects promising higher growth potential.

The Paydax Protocol exemplifies this trend, attracting attention as a potential outperformer during ETH's consolidation phase. Market participants are closely monitoring whether this capital rotation represents a temporary shift or a more sustained trend favoring emerging protocols over established assets.

India Blockchain Month 2025 Kicks Off with Regulatory Focus in Delhi

India Blockchain Month (INBM) 2025 has launched in New Delhi, positioning the city as a global epicenter for Web3 innovation. The event, now in its second iteration, draws thousands of developers, founders, investors, and policymakers to accelerate India's role in the digital asset economy.

Key gatherings on September 25-26 at JW Marriott and Welcomhotel by ITC Hotels will run concurrently with ETHGlobal Delhi Week, creating a concentrated hub of talent and capital. The agenda features eight flagship events, including discussions on AI-blockchain convergence, real-world asset tokenization, and venture capital networking.

A Regulatory Roundtable takes center stage, uniting policymakers and industry leaders to shape India's digital asset oversight framework. Notable participants include Dilip Chenoy, Chairman of Bharat Web3 Association, alongside other influential voices from the Indian blockchain ecosystem.

Vitalik Buterin Highlights Fusaka's PeerDAS as Pivotal for Ethereum Scaling

Ethereum co-founder Vitalik Buterin has underscored the transformative potential of the upcoming Fusaka upgrade, particularly its PeerDAS feature. "PeerDAS is trying to do something pretty unprecedented," Buterin stated in response to concerns about data inefficiencies raised by Dragonfly's hildobby. The protocol aims to enable a live blockchain without requiring any single node to download full data—a breakthrough for scalability.

The Dencun upgrade's introduction of blobs (EIP-4844) laid groundwork by temporarily storing data for 18 days, reducing long-term storage burdens. PeerDAS now pushes this further, prioritizing both innovation and safety. "Fusaka will fix this," Buterin affirmed, signaling a leap in Ethereum's capacity to handle data without compromising decentralization.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical analysis and fundamental factors, BTCC financial analyst Mia provides the following ETH price projections:

| Year | Price Prediction | Key Drivers |

|---|---|---|

| 2025 | $3,800 - $5,200 | Regulatory clarity, institutional adoption, scaling solutions |

| 2030 | $8,000 - $15,000 | Mass DeFi adoption, enterprise blockchain integration |

| 2035 | $15,000 - $30,000 | Global CBDC integration, mature Web3 ecosystem |

| 2040 | $25,000 - $50,000+ | Digital economy dominance, scarce digital asset status |

These projections consider Ethereum's current technical position, ongoing development roadmap, and the broader cryptocurrency adoption curve. Near-term volatility is expected given regulatory uncertainties and market sentiment shifts.